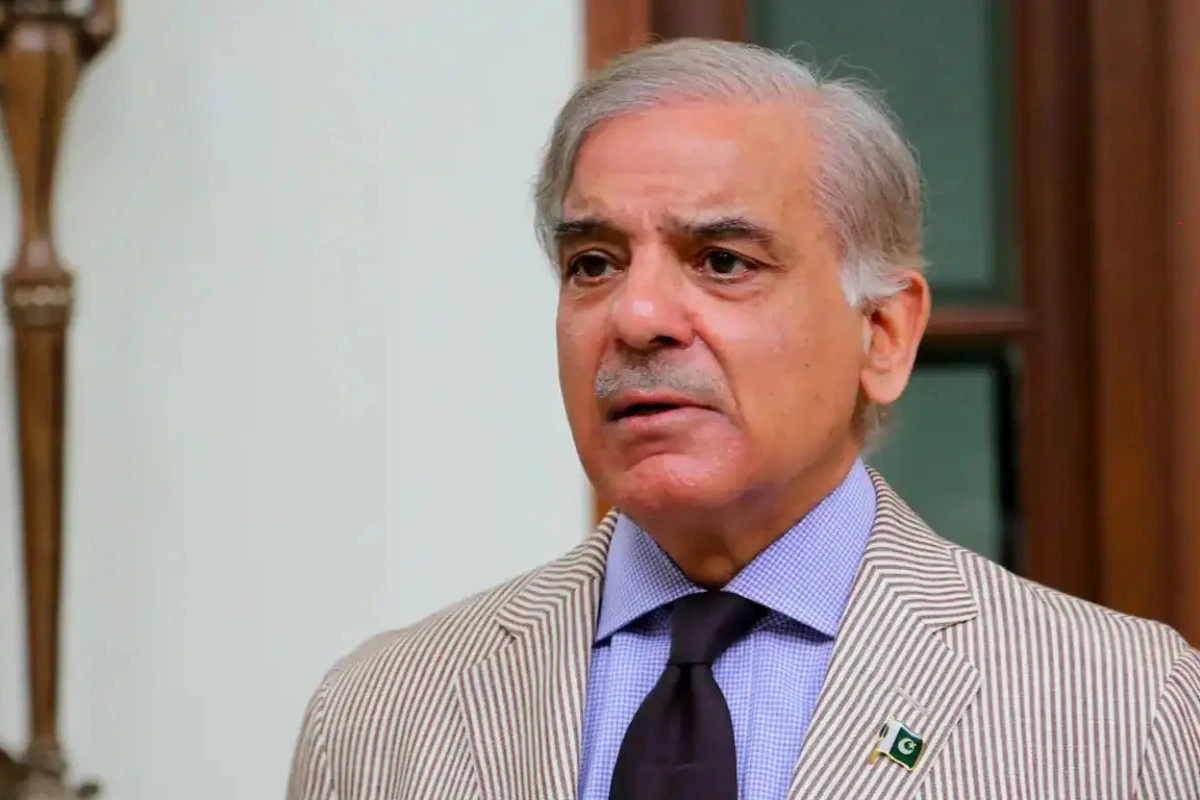

Pakistan Prime Minister Shehbaz Sharif has encountered resistance from the International Monetary Fund (IMF) after seeking a reduction in sales tax on condoms and other family-planning products. According to media reports, the IMF has declined the request, stating that any changes to tax policy can only be reviewed during the formulation of the next federal budget.

At present, contraceptives in Pakistan attract an 18 per cent general sales tax, and the IMF’s decision means that prices will remain unchanged for the foreseeable future. The government had argued that lowering taxes on birth-control products was necessary to make them more affordable for the public, particularly in light of the country’s rapidly rising population.

Pakistan remains heavily reliant on IMF financial assistance to stabilise its struggling economy. The country is currently operating under a 37-month IMF loan programme, supplemented by an additional facility aimed at long-term economic reform and climate resilience. The IMF has already disbursed approximately USD 3.3 billion, with a further USD 1.2 billion approved in subsequent tranches. These funds come with strict conditions, including stronger tax enforcement, governance reforms, and anti-corruption measures.

Despite Pakistan’s population growth rate of around 2.55 per cent—adding nearly six million people annually—the government faces limited flexibility in reducing taxes on essential health products. IMF guidelines restrict mid-year tax exemptions under the ongoing loan agreement.

Reports from Pakistani media outlets including The News International and Geo News indicate that the proposal to remove GST on condoms, sanitary pads, and baby diapers was formally submitted by the Federal Board of Revenue (FBR) following instructions from the prime minister. However, IMF officials rejected the proposal, citing the inability to alter tax structures outside the annual budget process.

Financial estimates presented by the FBR suggested that eliminating GST on condoms alone would result in a revenue loss of Rs 400–600 million. The IMF opposed this move, particularly as Pakistan is already struggling to meet its revised annual revenue target of PKR 13.979 trillion. The global lender also cautioned that such tax concessions could weaken revenue collection and increase the risk of smuggling.

As a result, any potential relief on taxes for contraceptives and other essential hygiene products will now have to wait until discussions for the 2026–27 fiscal budget.